Car loans can be. Real interest rates traditionally exceed nominal rates.

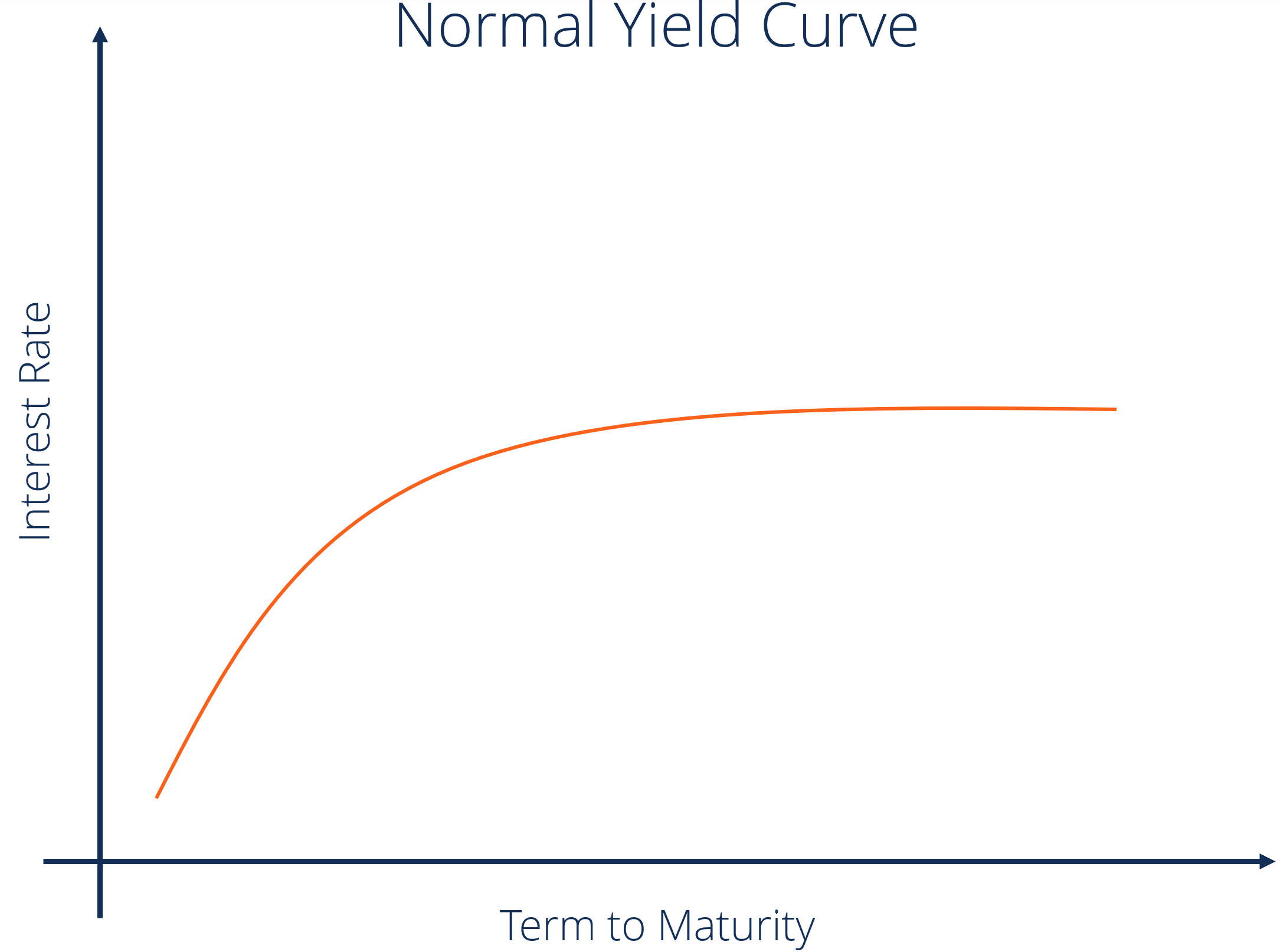

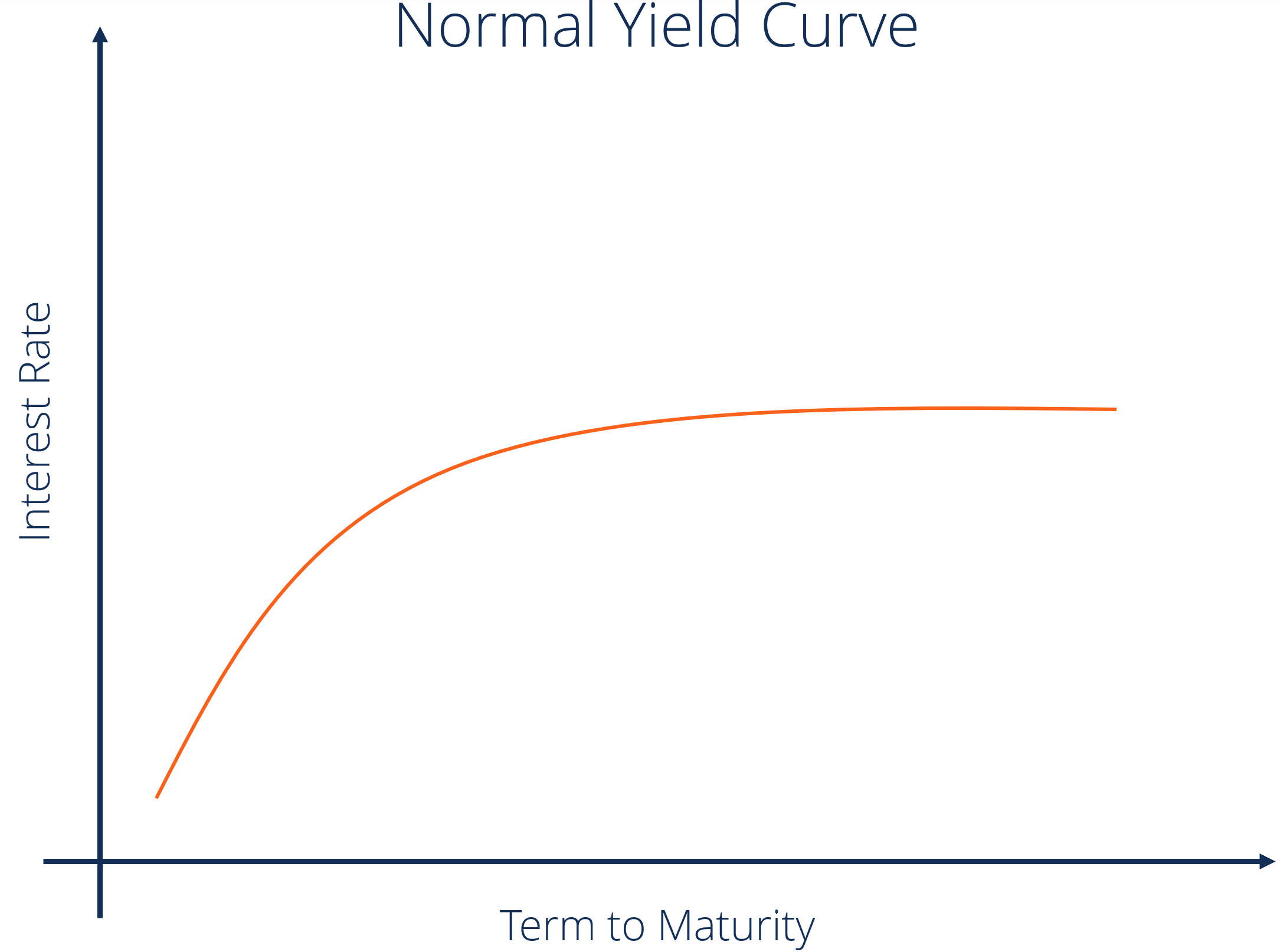

Yield Curve Definition Diagrams Types Of Yield Curves

Which of the following statements best describes the real interest rate.

. What type of bank account typically offers no interest. A swap is usually worth close to zero when it is first negotiated B. Which of the following statements best describes the real interest rate.

Correct answer to the question Question 8 of 10 Which of the following will typically offer zero interest rate. The national average interest rate for savings accounts is 006 APY according to the Federal Deposit Insurance Corp. Which of the following will typically offer the lowest interest rate.

An interest rate is a percentage that describes how much a borrower will be paid for a loan. Certificate of deposit CD. Sears is a store that gives a relatively low interest rate.

I just recieved the correct answer on my quiz. The amount of interest that has accrued will typically be credited monthly or quarterly. D Real interest rates traditionally exceed nominal rates.

Piggy bank will typically offer zero interest rate. This problem has been solved. Which of the following is true for an interest rate swap.

None of the above. Which of the following are examples of types of savings vehicles. Comparative advantage is a valid reason for entering into the swap D.

Real interest rates can be negative zero or positive. 5 These rates will be 04 higher without autopay. A major purchase that might otherwise require a lump-sum payment can be spread out over 12.

Which of the following is true for an interest rate swap. None of the above. What typically has the lowest fees or costs to use.

Online banks typically offer. Companies that offer zero-interest loans tout these vehicles as no-lose opportunities for borrowers. A A swap is usually worth close to zero when it is first negotiated B Each forward rate agreement underlying a swap is worth close to zero when the swap is first entered into C Comparative advantage is a valid reason for entering into a swap D None of the above.

Its often quoted as an annual rate but depending on the situation interest can be quoted and calculated in a variety of ways. Each forward rate agreement underlying a swap is worth close to zero when the swap is first entered into C. When you deposit money in an interest-bearing savings account you.

A zero-coupon bond is a debt security that doesnt pay interest a coupon but is traded at a deep discount rendering profit at maturity when the bond is redeemed for its full. What typically have the highest fees. The term referring to the rate of yearly interest for your credit card is commonly known as.

Which of the following typically has the lowest fees or costs to use. A swap is usually worth close to zero when it is first negotiated B. Credit cards typically have higher interest rates than personal loans.

Each forward rate agreement underlying a swap is worth close to zero when the swap is first entered into C. Real interest rates can decline only to zero. Credit card rates are typically non-negotiable unlike personal loans.

Credit cards can have variable interest rates so you know you are getting the best deal. B Real interest rates can decline only to zero. Which of the following is true for an interest rate swap.

Its rates start at 219 for new cars for 60 months and 254 for used cars as of March 2022. Which type of bank account typically offers no interest. Other stores like Jordans Furniture and Hope Depot offer no interest if you spend more than a minimum amount.

Savings bond O B. Which of the following will typically offer the lowest interest rate A. When you borrow money you pay interest to the lender.

The following day the daily interest rate is applied to this new balance increasing the yield in the account. Rate of return matters. Based on our forecast that Bank Rate will rise to 125 by year-end and to 200 in 2023 the average rate on new mortgages is set to double from a low of 15 in November 2021 to almost 30.

Comparative advantage is a valid reason for entering into the swap D. Alliant Credit Union offers financing for both new and used vehicles. PLEASE EXPLAIN A Real interest rates exceed inflation rates.

Credit cards sometimes offer free extended warranties on large purchases made with the card. Real interest rates exceed inflation rates. C Real interest rates can be negative zero or positive.

Federal student loans have a fixed interest rate.

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

0 Comments